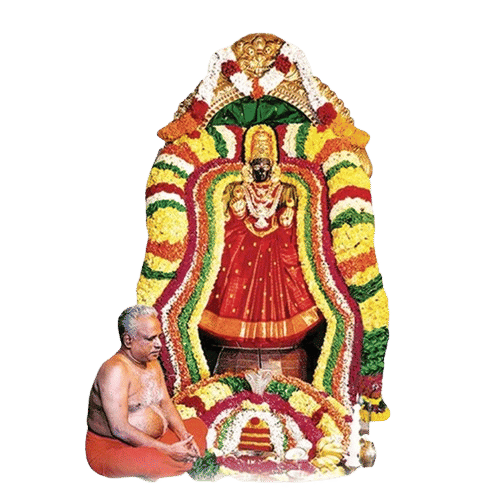

Donate to

ASPWCT Trust

Your generous contribution helps us continue our mission of serving humanity through healthcare, education, and cultural preservation.

80G Tax Deduction Benefits

Recognized Organizations

It is essential to make sure that donations are given to recognized organizations. Donations to specified funds and charitable institutions qualify for deductions under Section 80G.

Verify Registration

Not all donations are eligible for tax benefits, so it is essential to verify the organization's registration under Section 80G before making a contribution.

Cash Donation Limit: Rs. 2,000

Contributions made in cash exceeding Rs. 2,000 are not eligible for tax deduction benefits under Section 80G. Hence, it is advisable to make donations through banking channels or cheques.

Tax Deduction Rates

Taxpayers can avail different rates of deduction based on the nature of the charitable organization and the donation made.

Full Deduction

Donations to institutions that provide relief to the poor, promote education, or support rural development are eligible for a 100% deduction.

Partial Deduction

For donations made to other charitable institutions, the deduction is limited to 50% of the donated amount.

Limits on Deductions

- The total deduction claimed under Section 80G cannot exceed 10% of the taxpayer's gross total income.

- For certain donations, the limit is restricted to 100% of the donated amount.

Claiming Tax Deduction

To avail tax benefits on donations under Section 80G, taxpayers need to ensure the following:

Step 01

Obtain a receipt with 80G registration number & PAN.

Step 02

Report donation details accurately in ITR filing.

Step 03

Keep records of all donations made during the financial year.